HubSpot Diamond Solutions Partner

HubSpot + Encompass Integration: Unify Your Borrower Journey from Lead to Close

Connect your marketing and sales engine in HubSpot with your core Loan Origination System. This integration automates data flow, eliminates manual entry, and provides end-to-end visibility into your lending pipeline.

Get Your Free HubSpot Consultation + Claim The 2025 CRM Growth Playbook Instantly for FREE

Discover how top companies use their CRM to power marketing, sales & growth. No spam. No sales pitch. Just expert insights from certified HubSpot professionals.

(Offer valid for Limited Time Only)

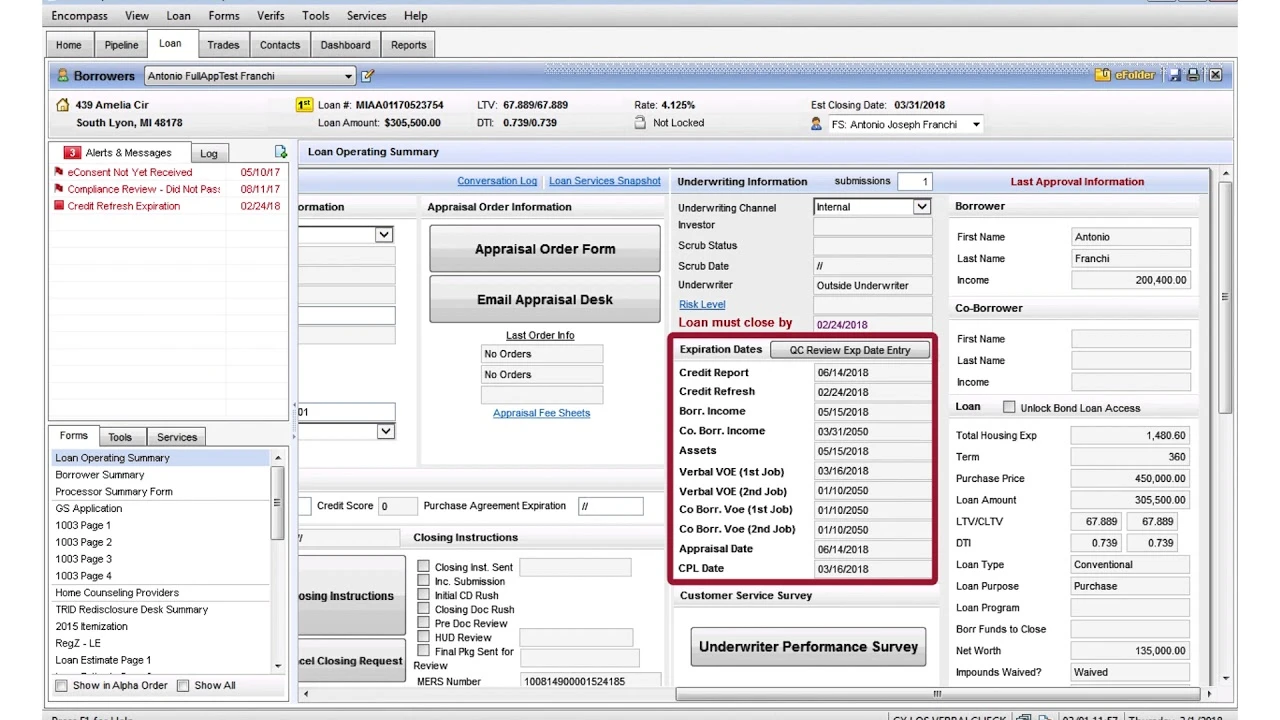

Streamline Loan Origination in Encompass

Eliminate the time-consuming and error-prone process of manually creating and updating loan files. By automatically pushing qualified borrower data from HubSpot directly into Encompass, your loan officers and processors can start working on applications faster with complete, accurate information from the very beginning.

Automate Loan File Creation: Automatically create new Loan Files and Borrower records in Encompass the moment a prospect reaches the application stage in HubSpot, reducing administrative workload.

Ensure Data Accuracy from the Start: Pre-populate loan applications with accurate contact, property, and preliminary financial information captured in HubSpot, minimizing manual data entry errors.

Provide Full Pre-Application Context: Equip loan processors and underwriters with the complete history of sales notes and marketing engagement from HubSpot, synced directly to the Encompass conversation log.

Maintain Data Consistency: Utilize a bi-directional sync to ensure key borrower contact information is always up-to-date in both systems, creating a single source of truth.

Eliminate the time-consuming and error-prone process of manually creating and updating loan files. By automatically pushing qualified borrower data from HubSpot directly into Encompass, your loan officers and processors can start working on applications faster with complete, accurate information from the very beginning.

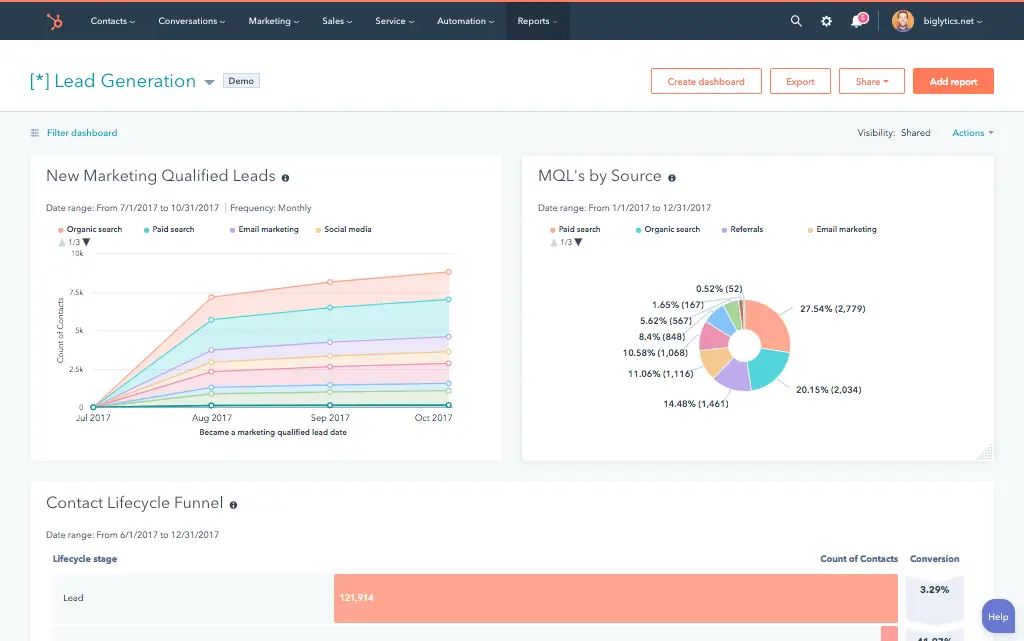

Gain Real-Time Visibility into Your Loan Pipeline in HubSpot

Transform HubSpot into a true command center for the entire borrower journey. By syncing key loan milestones from Encompass back to HubSpot, your marketing teams and loan officers gain unprecedented visibility, enabling automated communication and accurate, closed-loop ROI reporting.

Empower Your Loan Officers: Provide Loan Officers with real-time visibility into their loan files' status and key milestones (e.g., Processing, Underwriting, Approved) directly on the HubSpot Contact record.

Automate Borrower Communication: Trigger personalized, timely status updates and nurture campaigns from HubSpot to borrowers and real estate agents as the loan progresses through Encompass milestones.

Achieve True Closed-Loop Reporting: Sync funded loan data and key financial details from Encompass back to HubSpot to definitively measure marketing campaign ROI and track performance from lead to close.

Build a Unified Borrower View: Combine all top-of-funnel marketing and sales engagement with all back-end loan processing details in a single, chronological timeline.

Transform HubSpot into a true command center for the entire borrower journey. By syncing key loan milestones from Encompass back to HubSpot, your marketing teams and loan officers gain unprecedented visibility, enabling automated communication and accurate, closed-loop ROI reporting.

A Secure & Compliant Sync for the Mortgage Industry

Our custom integrations are engineered for flexibility and scale, handling any business logic and data transformation you require.

Built for Your Lending Process

Your lending workflow is your competitive advantage. Our integration is configured to map to your institution's specific processes, custom milestones, and data fields within Encompass, ensuring the technology adapts to your business, not the other way around.

- Bi-Directional & Uni-Directional Sync: Control the flow of sensitive data with precision, defining which system is the master record for every piece of information.

- Real-time & Scheduled Syncs: Utilize real-time triggers for immediate actions like loan file creation and scheduled syncs for large-scale data updates and reporting.

- Custom Sync Logic & Triggers: Define the exact business rules for data transfer, such as pushing a contact to Encompass only after a specific application form is submitted.

- High-Volume Data Handling: Our enterprise-grade architecture reliably processes a high volume of loan files and borrower data, scaling with your institution's growth.

Comprehensive Object & Field Mapping

We support the full range of objects essential for managing the end-to-end mortgage process. Our deep mapping capabilities connect your sales pipeline to your loan origination engine for a completely unified data model.

HubSpot

Encompass

- Contacts

- Companies

- Deals

- Custom Objects

- Leads/Contacts

- Accounts

- Opportunities

- Custom Objects

- Contacts Leads/Contacts

- Companies Accounts

- Deals Opportunities

- Custom Objects Custom Objects

Why Integrate IQ?

Our four pillars for delivering successful outcomes on complex projects.

Mastery of Complexity

We thrive on custom API integrations, multi-system migrations, and "messy data" that makes others pause. Full support for standard and custom objects across your stack is table stakes for us.

Pragmatic Innovation

Real problems, shipped solutions. Our proprietary Smart Ramp apps were developed to fill gaps in HubSpot capabilities and solve real-world customer problems. The same practical mindset powers our HubSpot AI Accelerator: We focus on data readiness and shipped outcomes, not shiny features.

De-Risking the Process

Complex projects demand clarity. Our Smart Process runs on an 8-12 week cadence with stage gates, transparent deliverables, and clear pricing. That's how we maintain a 98.5% customer retention rate.

The Expert You Call

We're a developer-led team of integration engineers, solution architects, and technical PMs. Clients describe us simply: 'the folks you call when something seems impossible.'

Trusted by High-Growth Companies

See why leaders at scaling companies partner with Integrate IQ's experts.

Frequently Asked Questions

Security and compliance are our top priorities. All data is encrypted in transit and at rest, and we utilize secure, API-based connections. Our platform is SOC 2 compliant and designed to meet the rigorous data security standards of the financial services industry.

Yes. Mapping to custom fields and milestones is a core capability of our solution. We work with your team to map your unique Encompass configuration to corresponding properties in HubSpot, ensuring the integration aligns perfectly with your established lending process.

Absolutely. We configure the integration to trigger based on your specific business rules. For example, a Loan File can be automatically created only when a HubSpot Deal is moved to a stage like "Application Submitted," ensuring clean data and a controlled workflow.

Our platform uses robust deduplication logic. Before creating any new record in Encompass, it checks for existing borrowers based on unique identifiers like email address or phone number to prevent creating duplicate files and ensure data integrity.